Division 35 – Non-Commercial Loss Rules (ATO-Verified & Easy Guide)

📉 Division 35 – Non-Commercial Loss Rules (ATO-Verified & Easy Guide)

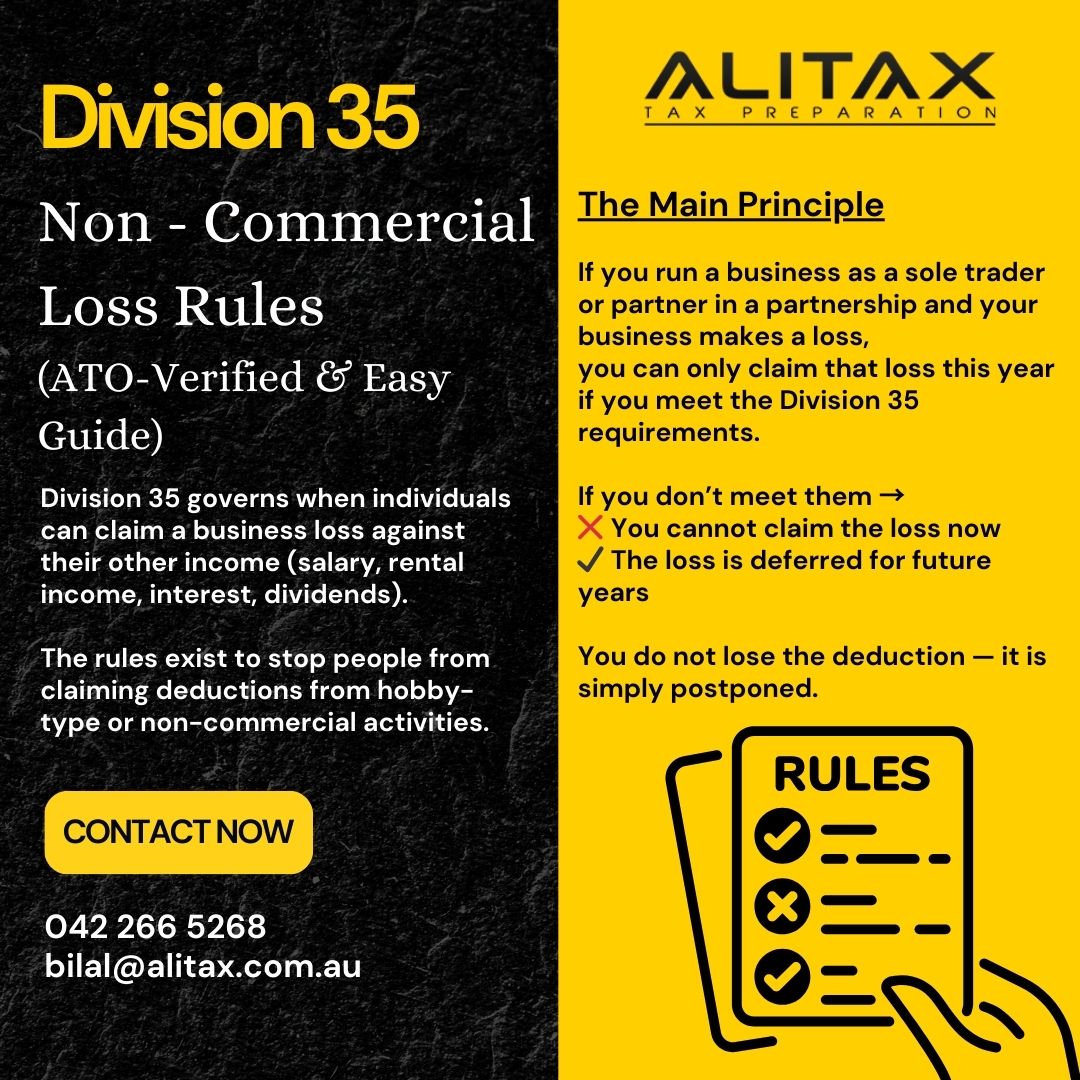

Division 35 governs when individuals can claim a business loss against their other income (salary, rental income, interest, dividends).

The rules exist to stop people from claiming deductions from hobby-type or non-commercial activities.

🚨 The Main Principle

If you run a business as a sole trader or partner in a partnership and your business makes a loss,

you can only claim that loss this year if you meet the Division 35 requirements.

If you don’t meet them →

❌ You cannot claim the loss now

✔ The loss is deferred for future years

You do not lose the deduction — it is simply postponed.

📘 ATO Tax Rules — When You CAN Use the Loss (Meet ONE test)

To claim the business loss immediately, you must satisfy at least one of the following four tests:

1️⃣ Assessable Income Test

Your business must have at least $20,000 in assessable income for the year.

2️⃣ Profits Test

Your business must have made a tax profit in 3 out of the last 5 years (including the current year).

3️⃣ Real Property Test

You use $500,000 or more in real property (land/buildings) in the business.

Note: Your personal residence does not count.

4️⃣ Other Assets Test

You use $100,000 or more in business assets, such as:

Machinery

Equipment

Tools

Cars are excluded from this calculation.

🚫 When You CANNOT Use the Loss

If you fail all four tests:

The loss cannot reduce your salary or investment income this year

The loss becomes a deferred non-commercial loss

You can claim it later when:

✔ The business meets a test, or

✔ The business becomes profitable

🧾 Additional ATO Tax Rules You Should Know

✔ Applies only to individuals

Division 35 applies to:

Sole traders

Partners (at the individual level)

It does not apply to companies or trusts.

✔ Deferred losses can only offset future business income

They cannot reduce salary, rental income, or investment income until they are allowed under Division 35.

✔ ATO Discretion (Special Circumstances)

You can ask the Commissioner for special permission to claim the loss now if:

Your business is new but genuinely commercial

Profit is expected in future years

The business was affected by events outside your control (e.g., natural disaster)

✔ Exceptions (Where Division 35 is lighter)

The rules may not apply, or apply more leniently, for:

Primary producers

Professional artists

Individuals with taxable income under $40,000